For those of us who have discovered high yielding income ETFs, we often think we have discovered El Dorado, or something like Atlantis, or the financial Fountain of Youth.

These yields can be astounding at 40, 50, or even 100% in terms of annual dividends. But the problem is that most of these funds are not able to consistently yield these amounts without chiseling away huge chunks of the NAV, or underlying stock price.

It’s much like an open-pit coal mine: yes you get the goods, but you lose the land too:

NAV Erosion or Yield Max

I don’t mean to pick on the income ETF company YieldMax, but it’s flagship product YieldMax™ TSLA Option Income Strategy ETF (TSLY) is kind of a parable of NAV Erosion.

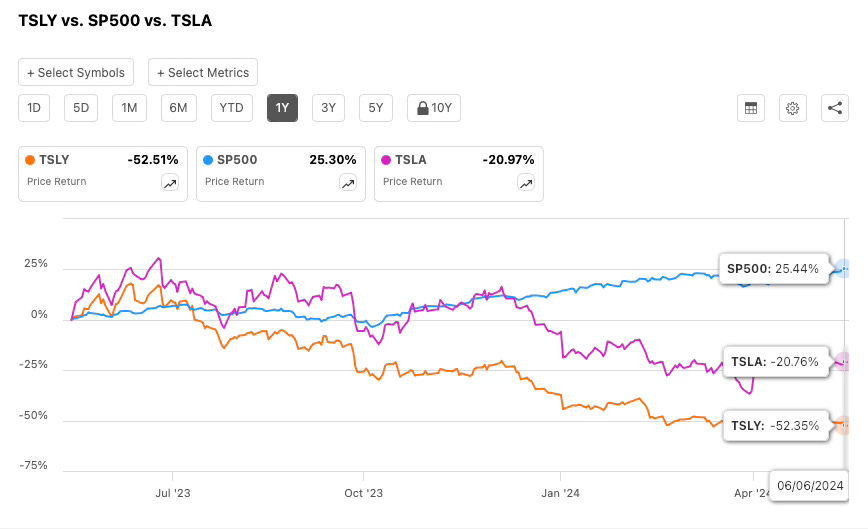

YieldMax (TSLY) vs S&P 500 (SPY) vs Tesla (TSLA)

In the above chart you can see the 1 year price return on Tesla, TSLY, and a standard S&P Index ETF (SPY). Over the last year as Tesla has suffered, so has the covered-call ETF TSLY. Of note this is without TSLY dividends reinvested.

YieldMax (TSLY) vs Tesla (TSLA) vs S&P 500 (SPY) - with Dividend Reinvestment

Even with dividends reinvested, TSLY fails to stop the bleed.

Add to the recent difficulty of TSLY needing to reverse split (2 for 1) their share to get the NAV back up to manageable size… and the fund has already descended to 15 dollars from it’s reverse split at 20.

Huge Yields Only Manageable If….

The lesson many of us learned with TSLY was that high yielding dividend stocks are only able to sustain these yields under certain circumstances:

The fund’s NAV needs to be able to consistently recoup the deduction of the dividend each month.

The underlying asset needs to be in a bull market cycle or else the fund will be unable to recoup the div paid in the previous month.

Growth Almost Always Beats Income

Another thing I have noticed about income investing is that the underlying asset almost always outperforms the income ETF following it.

Now even with that in mind, there may be certain reasons why an investor would favor income ETFs over growth stocks anyway including getting capital from the investment without selling, and that some funds may generate dividends as Return of Capital which in many cases is not taxed (until dividends cover the cost of the initial investment), as well as living off the investment income without needing to sell any shares.

Schwab U.S. Dividend Equity ETF (SCHD) vs SPDR Dow Jones Industrial Average ETF Trust (DIA) vs ProShares UltraPro Dow30 ETF (UDOW) - Dividends Reinvested

Here’s an example of how even a very solid fund like Schwab U.S. Dividend Equity ETF (SCHD) which has maintained its NAV very well is not able to perform as well as a growth ETF like the only ETF that follows the Dow Jones (DIA).

SCHD has a respectable 11.8% 1 year return with divs reinvested, while DIA itself has a 17.37% return, and just for the super growth people I included the 3x leveraged Dow fund (UDOW) - a 37.51% 1 year return.

This shows the general principle that growth usually beats income in total return.

Pick Your Reason for Investing

Ultimately if you are investing to maximize your returns, you need to invest in a growth-based fund.

If you are investing to have some kind of income, then you must be sure that the underlying asset is in a bullish cycle and that the NAV does not decay even if the dividends are whopping.

This is the lesson I have learned while maxing my dividends, hope it helps.

THIS IS NOT INVESTMENT ADVICE

POST FOR INFORMATIONAL PURPOSES ONLY